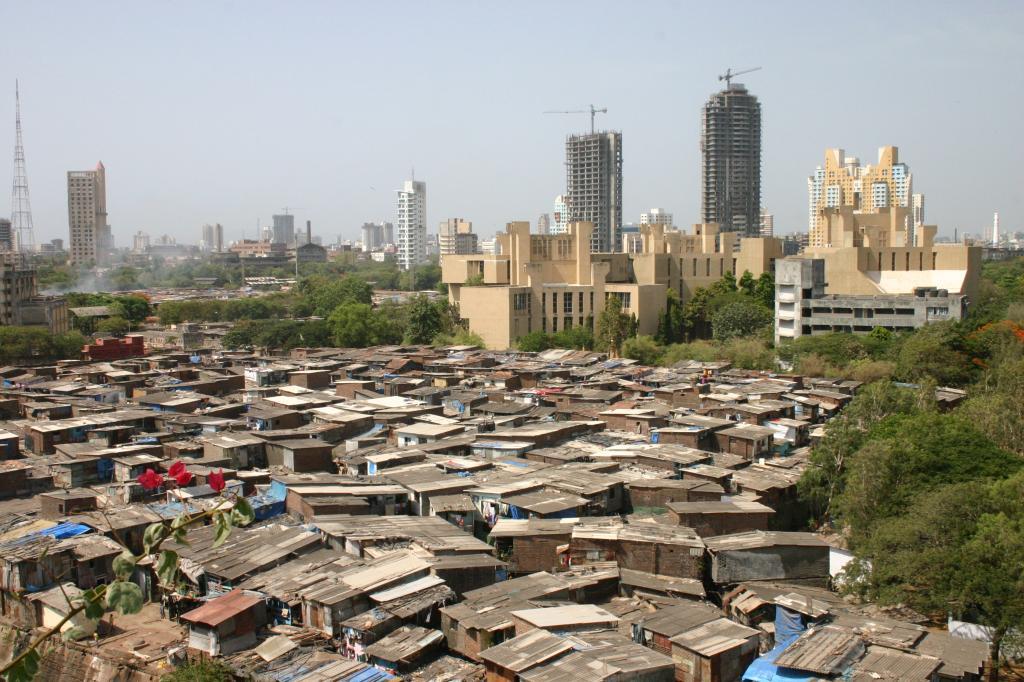

A recent study from the World Inequality Lab sheds light on the stark realities of wealth and income distribution in India, revealing trends that underscore an intensifying concentration of wealth. According to a recent report, the study titled Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj, a staggering 22.6% of the nation’s income in 2022-23 was claimed by the top 1% of earners. This figure represents the most significant share in the past century. Similarly, in terms of wealth distribution, the top 1% held a formidable 40.1% of the wealth in 2022-23, marking the highest level since 1961.

According to a recent report, the study titled Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj, a staggering 22.6% of the nation’s income in 2022-23 was claimed by the top 1% of earners.

This is in stark contrast to the CEO of Niti Aayog’s claim that poverty in India has fallen to less than 5%, given that the government is still offering free cereals to two-thirds of the country’s population—a program that is scheduled to run until 2029—and raises important questions about the true extent of economic inequality in India, a country that has experienced rapid growth but is still beset by structural inequality.

The concentration does not stop with the ultra-wealthy. The top 10% of Indians now hold 65% of the nation’s wealth, up from 45% in 1961, while the share belonging to the bottom 50% and the middle 40% has seen a decline, painting a picture of an increasingly polarised economic landscape.

A historical perspective on wealth inequality

Comparing current inequality levels with historical data, including the era of the British Raj, these findings highlight a paradox within India’s economic narrative. Despite achieving substantial reductions in poverty levels, the wealth gap continues to widen, driven by a growth model that disproportionately favours the affluent. The rise in wealth concentration, particularly pronounced between 2014-15 and 2022-23, suggests that modern India is potentially more unequal than during the British Raj.

That is, according to a report by the World Inequality Lab, India has surpassed the wealth concentration levels observed during the British colonial period, marking a significant milestone in its economic trajectory. The report reveals that both the income and wealth of the top 1% of the population have reached unprecedented historical highs, signaling a deepening divide within the nation.

The report reveals that both the income and wealth of the top 1% of the population have reached unprecedented historical highs, signaling a deepening divide within the nation.

Comparatively, India’s wealth inequality might not reach the extremes seen in countries like Brazil and South Africa, but it surpasses them in terms of income inequality. This distinction is critical as income disparities often precede and exacerbate wealth concentration, setting a trajectory that could see inequality widen further if unaddressed.

This complex scenario poses significant challenges for policymakers. The continuation of the government’s cereal distribution program reflects an acute awareness of these ongoing economic pressures, even as official poverty metrics suggest significant progress. The persistence of such schemes underscores the need for a nuanced understanding of poverty, one that considers inequality as a crucial factor in crafting effective economic and social policies.

How is this affecting the nation?

The detrimental effects of inequality on economic growth and poverty reduction take center stage recently with the reports, underscoring the urgency of addressing disparities. Research suggests that as inequality widens, the impact of economic growth on poverty alleviation diminishes, highlighting the interconnectedness of these socio-economic factors. Moreover, the influence wielded by the super-rich on decision-making processes, evident in episodes like the electoral bonds controversy, underscores concerns about the exclusionary nature of such power dynamics.

This not only undermines citizens’ rights but also skews social and environmental impact decisions. Furthermore, inequality breeds economic and political instability, dampening investment and hindering overall growth prospects. As the elite gain more influence, the provision of public goods crucial for productivity and growth may suffer, exacerbating disparities and disproportionately affecting the poor. The unfolding scenarios in India reflect the tangible manifestations of these dynamics, emphasising the need for proactive measures to address inequality’s multifaceted impacts.

The significance of inequality has become a focal point among economists, including those with conservative leanings. As per the reports, the recent studies by the International Monetary Fund (IMF) have also highlighted the detrimental impact of income inequality on economic growth and its sustainability. One study reveals an inverse relationship between the income share of the wealthy and overall economic growth, indicating that when the top 20% of the population see their share increase by 1 percentage point, GDP growth dips by 0.08 percentage points over the subsequent five years.

This challenges the notion of ‘trickle-down’ benefits, as the gains primarily benefit the affluent. Conversely, an equivalent increase in the income share of the bottom 20% correlates with a notable boost of 0.38 percentage points in growth, underscoring the importance of addressing inequality for sustained economic progress.

The role of government policies in addressing wealth disparities

Addressing these shortcomings requires comprehensive policy reforms, including updating valuation methods, closing loopholes, and implementing progressive tax structures. By harnessing the full potential of property taxation, governments can not only generate much-needed revenue but also promote greater equity and social cohesion, fostering a more just and prosperous future for all. The role of government policies in addressing or failing to address, in the ongoing struggle against economic inequality, the often-overlooked role of property taxation emerges as a critical factor.

Despite its potential to generate substantial revenue, especially at the local level, property taxation remains underutilised, capturing only a fraction of its possible earnings. This failure exacerbates the wealth gap by allowing disproportionate accumulation among property owners while depriving communities of vital resources. Outdated valuation methods, inadequate enforcement, and loopholes favouring the affluent contribute to this shortfall. address—the growing divide is crucial. As governments grapple with the complexities of economic inequality, property taxation emerges as a promising avenue for effecting change.

Looking ahead: challenges and opportunities

As India stands on the cusp of becoming a global economic powerhouse, the imperative to address these disparities has never been more urgent. Without intervention, the dream of inclusive growth remains just that—a dream, with the reality being a nation increasingly divided by wealth.

As India strides towards becoming a global economic powerhouse, it confronts the dual challenge of sustaining growth while mitigating deep-rooted inequalities. The nation’s economic landscape is poised at a critical juncture, marked by robust technological adoption and demographic dividends, juxtaposed with persistent wealth gaps and poverty. Addressing these disparities requires innovative policy interventions that not only fuel economic growth but ensure it is inclusive. Potential strategies include enhancing access to quality education and healthcare, investing in digital infrastructure to bridge the urban-rural divide, and reforming tax systems to ensure wealth redistribution.

Additionally, fostering entrepreneurship and skill development can empower the underprivileged sections, creating a more equitable economic environment. As India continues its economic ascent, the integration of these policies could play a pivotal role in shaping a balanced and inclusive future, transforming challenges into opportunities for all strata of society.

In conclusion, the widening wealth gap in India underscores the urgent need for proactive measures to address inequality.

In conclusion, the widening wealth gap in India underscores the urgent need for proactive measures to address inequality. The stark realities revealed by studies like those conducted by the World Inequality Lab and the IMF challenge conventional narratives of economic progress. As India grapples with the paradox of prosperity amidst persisting structural inequalities, policymakers face daunting challenges in navigating these complex socio-economic dynamics. However, the path forward lies in recognising the interconnectedness of wealth distribution, economic growth, and governance, and implementing comprehensive reforms that prioritise inclusivity and equity.