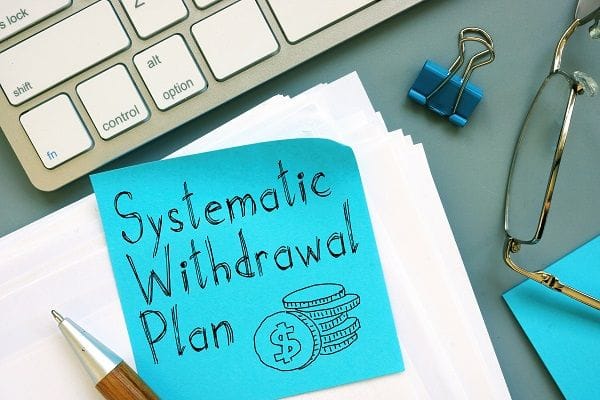

Many of us think about earning a second income at some point. One option that has been gaining traction lately is setting up a second income stream through mutual funds — specifically, through a facility called a Systematic Withdrawal Plan or SWP.

Now, if you’ve already built a corpus or are investing with the intent of setting up an income stream in the future, an SWP can be a suitable option. But how do you figure out how much to withdraw every month without running out of funds too soon? That’s where an SWP calculator can be useful. Let’s take a closer look at how this works.

What exactly is an SWP and why does it matter for second income?

An SWP is a feature that allows you to withdraw a fixed amount of money from your mutual fund investment at regular intervals—usually monthly. Think of it as the opposite of an SIP (Systematic Investment Plan), where you’re investing regularly. In an SWP, you’re withdrawing regularly. The rest of your corpus remains invested and continues to potentially grow depending on market conditions. This can make your funds last longer than they may have if you had redeemed the entire amount in one go.

Such a facility can be suitable for retirees who are seeking regular income to manage expenses or for those looking for a secondary income stream.

The key here is to find a balance. You want to withdraw enough to meet your needs, but not so much that your investment runs out too quickly. That’s where planning matters.

How the SWP calculator can help

If you’re wondering how much you can withdraw each month without depleting your funds too early, a calculator can help plan that. Most SWP calculators let you input your total mutual fund amount, expected rate of return, the fixed monthly withdrawal you want, and the duration.

Based on these numbers, it shows you how long your investment might last or how much you could potentially withdraw. You can keep adjusting the values to see different scenarios—for example, what if you withdraw Rs. 10,000 a month vs. Rs. 15,000? What if the return is 8 percent instead of 10 percent?

Bear in mind that the calculator’s results are based on the return rate that you input. Mutual funds do not offer guaranteed returns. Markets go up and down, and that affects how your investment grows over time. So, while the calculator helps, it’s still important to be conservative in your expectations.

Using SWP for a second income: Some examples

A lot of people in their late 40s or early 50s can use SWPs to start drawing some regular income while they continue working. This gives them flexibility to slow down their pace of work, pursue something they are interested in, or ease into retirement.

Others use it post-retirement as a way to manage their monthly expenses in a structured manner. Instead of withdrawing lumpsums now and then, the SWP gives them a disciplined way to draw money at regular intervals.

In some cases, people also set it up for their parents as an income stream from an existing corpus that’s already been invested.

How long can your investment last? Use the calculator to check

This is probably the most important question. You might have Rs. 15 lakh invested in a mutual fund, and you want to withdraw Rs. 12,000 every month. Is that going to last for the next 10 years? Or will it run out in 6?

That’s something the SWP calculator can help you estimate based on assumed returns. Again, since returns are not fixed, it can be beneficial to run a few scenarios, including one with a very conservative estimate. Try different return figures—maybe 6 percent, 8 percent, and 10 percent—to get a sense of how things may change if markets don’t perform as expected.

It’s also a good idea to factor in inflation. What seems like enough today might not be sufficient a few years from now. Some calculators also allow you to set a step-up withdrawal option, where your monthly payout increases every year by a fixed percentage. If not, you can still simulate it manually.

Other mutual fund tools

There are several tools and calculators that are freely available online that can help you visualise the potential growth of your money or plan your investments. One such tool is a compound interest calculator. There are several such tools available online, including a daily compound interest calculator that allows you to see how your money could potentially grow over time if interest was compounded daily. While daily compounding does not apply to mutual funds, it can still be beneficial to understand and see how compounding works in action.

About the author(s)

Partner Content is carefully curated and socially relevant sponsored content created by FII's marketing team. It is separate from FII's editorial content and is identified as sponsored.