Posted by Renana Jhabvala, Sonal Sharma and Soumya Kapoor Mehta

The Indian financial landscape is undergoing a dramatic change. India witnessed a surge in bank account ownership during the 2011-2017 period: 80 percent of Indians owned a bank account in 2017–an increase of 45 percentage points since 2011. This surge is primarily attributed to the Pradhan Mantri Jan Dhan Yojana (PMDJY).

However, this push for financial inclusion has not achieved its true objective, which is to ensure that all citizens not only have access to bank accounts, but avail other facilities that come with it—formal credit, insurance, and overdraft, to name a few.

According to the Global Findex database released by the World Bank, roughly one out of two bank accounts in India remain inactive, about twice the average of other developing economies. Worse, the gender gap in these inactive accounts is notable: 54 percent of women account holders report not using their account, as opposed to 43 percent male account holders.

The finance gap needs to be considered against the more general narrative on outcomes for women in India, and progress therein. While there has been a big shift in girls’ education in the last decade or so–with more girls enrolling in higher secondary and college education–India’s abominably low female labour force participation rates mean that many girls, despite their aspirations, are passing out of schools with no employment prospects.

“Evidence shows that women tend to use their bank accounts and save and borrow more if they are served by female bankers and financial intermediaries.”

The debate on low female labour force participation and the reasons for it are intensive, and have sparked an entire research industry. However a study* conducted at SEWA commissioned as part of the World Bank’s Skill India Mission Operation (SIMO) focuses on the possible solutions, one of which is identifying work opportunities available for women in India’s financial sector.

Can the financial industry be a prospective employer for the many, now more educated women, seeking work outside their homes?

Why is this a matter of interest? Because evidence shows that women tend to use their bank accounts and save and borrow more if they are served by female bankers and financial intermediaries.

Also read: What Rural Women Can Teach Others About Finance And Innovation

So, what did we find?

First, female staff comprise a very small proportion of the financial industry workforce. The Bharat Micro-finance Report 2017 by Sa-Dhan reveals that the total micro-finance workforce in 2017 stood at 89,785 workers. Women comprised only 12 percent of the total workforce and 11 percent of the total field staff.

Our primary study confirmed these dismal numbers on women’s employment in the financial sector. Most of the field agents and employees of the financial institutions we interviewed were male. Perhaps the most dramatic example was that of micro-finance institutions where we found that while all the clients were women, all the officers in the field were male.

“Women comprised only 12 percent of the total financial industry workforce and 11 percent of the total field staff.”

Second, SEWA’s own studies suggest that women tend to save and borrow more when they are served by female financial intermediaries.

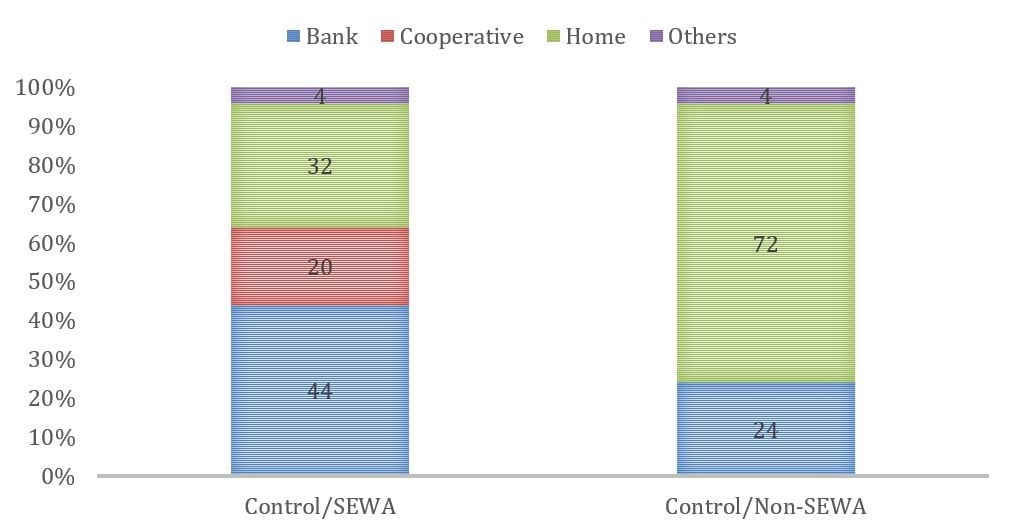

A basic income pilot conducted by SEWA in the state of Madhya Pradesh in 2011-12 compared the extent of financial inclusion in villages where SEWA operated through its network of vitya saathis (female banking correspondents) and villages where SEWA was not present.

It was found that in non-SEWA villages where no basic income was transferred, women held only 24 percent of their savings in financial institutions such as banks and cooperatives (figure 1). In comparison, in SEWA villages, 64 percent of women’s savings were in formal financial institutions.

Other internal studies of SEWA in Bihar and Uttarakhand also show a positive impact of financial intermediaries on women’s savings, and livelihoods.

Putting these two facts together, it is clear that hiring women as financial intermediaries can serve the dual purpose of increasing women’s usage of bank accounts on one hand, and their employment on the other.

The job opportunity for financial intermediaries is tremendous

According to the Reserve Bank of India (RBI), of the nearly 460 million basic saving accounts opened in scheduled commercial banks between March 2010 and March 2018, nearly one in every two was opened through business correspondence agents or financial intermediaries. Such is the importance of these agents that the National Skills Development Corporation (NSDC) estimates 3.7 million incremental jobs for financial intermediaries between 2016 and 2022.

This leads to three important policy insights:

- Financial intermediaries are capable of carrying out financial functions and are perhaps better than a brick-and-mortar financial institution in reaching out to remote areas owing to their mobility.

- There is ample opportunity for mobile agents to act as representatives of financial institutions.

- The potential for hiring women as such agents is high.

Yet, a report by the Helix Institute of Digital Finance (2015) on the Indian financial agent network finds that of the 2,682 active financial agents surveyed across rural and urban locations, only about 10 percent were women.

If these levels were raised to 30 percent, then of the 3.7 million projected jobs, 1.1 million could be taken up by women financial intermediaries, benefitting women account holders in the process.

Women face barriers to entering the financial workforce

- Women are not aware of jobs in the financial sector. There are few counselling centres in schools and colleges that expose girls to jobs in this sector.

- Not many girls and women think of financial institutions as possible employers, and if they do, the government ones are the most coveted.

- Women also feel that they do not have the skills required to make a career in finance; some fear the pressure of targets.

- Constraints on mobility and security present further restrictions as does the hesitation of seeing no female peers among existing staff.

- A male culture in the sector also serves as a barrier, with male staff often socializing over a drink, late after office hours; bonding events that tend to exclude women.

- Managers, on their part, are reluctant to hire women. When asked why there were almost no female staff in his bank, a bank manager emphasised “Daudne wala sales officer chahiye” (we need sales officers who are capable of running).

“Most obstacles seem to be related to the socially determined roles that women have been traditionally assigned.”

It is clear that most of the obstacles cited above seem to be related to the socially determined roles that women have been traditionally assigned. Both men and women view women’s abilities and aspirations through these lenses. This determines why women are either unaware of the opportunities, or are hesitant to enter the field. It also illuminates why managers fail to encourage women to apply, or when they do apply, only assign women back office jobs.

These barriers call for more awareness campaigns in communities about the importance of employment for women. Equally, some supply side shifts are needed.

They may include:

- Employing more female financial intermediaries

- Raising awareness about these jobs, knowledge building and career counselling

- Raising awareness among potential employers about the advantages of employing women and what they need to do to attract and retain them

- Providing financial support to buy laptops, point-of-sale machines, and two-wheeler vehicles for women who wish to become intermediaries

- Enabling access to technology

- Examining existing training modules and re-orienting them towards training women as financial intermediaries

At the policy level it requires partnerships between organizations like the NSDC, the Sector Skill Councils and the Association of Banks to create an ecosystem that works towards employing more women as financial intermediaries.

It also requires collection of gender disaggregated data by financial institutions on employees, agents, banking correspondents, customer service providers and other financial intermediaries and making these figures publicly available to track gender discrepancies in the sector.

Also read: My Ongoing Personal Journey To Financial Literacy As A Woman

*Sanchita Mitra was a contributing author to the larger study that this article draws on.

This article was previously published on India Development Review and is re-published here with permission.

Featured Image Source: Citigroup Blog

About the author(s)

India Development Review (IDR) is India's first independent online media and knowledge platform for the development community.