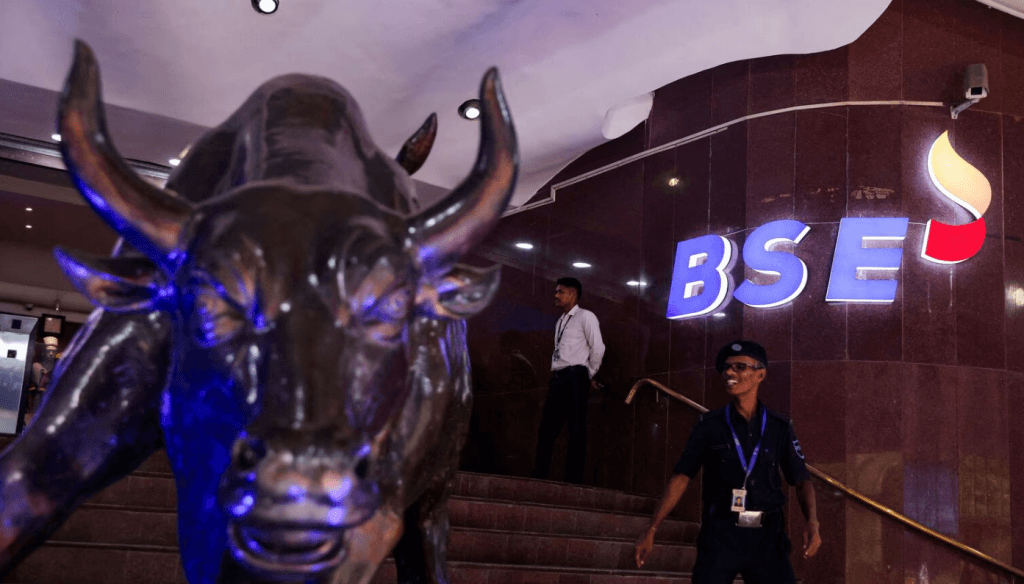

If you are actively involved in stock market activities or hold a demat account, it is important to stay informed about scheduled trading holidays. The BSE holidays 2025 list outlines the days when the Bombay Stock Exchange (BSE) will remain closed. These closures apply to equity trading, equity derivatives, and SLB (Securities Lending and Borrowing) segments.

Planning your trading activities around these holidays can help you avoid disruptions and stay prepared in advance. Whether you are a full-time trader or a long-term investor, being aware of non-trading days helps you manage your portfolio more efficiently.

Importance of knowing BSE holidays

Understanding the stock market holiday calendar is essential for the following reasons:

- It allows you to plan your trades or investments in advance.

- You can avoid order placements or transactions on non-working days.

- If you are dealing in futures and options, holidays may impact expiry dates and settlement timelines.

- In case of upcoming public issues, rights issues or dividends, knowledge of the BSE holidays can help you time your demat instructions accordingly.

BSE holidays 2025: Equity segment schedule

Here is the list of BSE holidays 2025 for the equity market segment as per the official calendar released by BSE India:

| Sr. No. | Date | Day | Holiday |

| 1 | 1 January 2025 | Wednesday | New Year’s Day |

| 2 | 26 January 2025 | Sunday | Republic Day |

| 3 | 27 February 2025 | Thursday | Maha Shivratri |

| 4 | 14 March 2025 | Friday | Holi |

| 5 | 31 March 2025 | Monday | Year-end Bank Closing |

| 6 | 14 April 2025 | Monday | Dr. Babasaheb Ambedkar Jayanti |

| 7 | 18 April 2025 | Friday | Good Friday |

| 8 | 1 May 2025 | Thursday | Maharashtra Day |

| 9 | 6 June 2025 | Friday | Eid-ul-Adha (Bakri Eid) |

| 10 | 15 August 2025 | Friday | Independence Day |

| 11 | 2 October 2025 | Thursday | Mahatma Gandhi Jayanti |

| 12 | 21 October 2025 | Tuesday | Dussehra |

| 13 | 30 October 2025 | Thursday | Diwali Laxmi Pujan* (Muhurat trading) |

| 14 | 31 October 2025 | Friday | Diwali-Balipratipada |

| 15 | 25 December 2025 | Thursday | Christmas |

Note: Muhurat Trading will be announced separately by BSE India closer to Diwali. Timings are typically in the evening for symbolic trading purposes.

Please refer to the BSE India website for official announcements or updates in case of changes or additions to the above list.

Settlement implications during BSE holidays

On exchange holidays, settlement processes such as pay-in/pay-out and trade processing are paused. It is important to consider the following when planning trades near holiday periods:

- T+1 and T+2 settlements may get delayed depending on the holiday placement.

- Demat transfers or delivery instructions submitted via your depository participant (DP) may be processed on the next working day.

- Dividends, bonus shares, and other corporate actions scheduled around holidays may reflect in your demat account after normal trading resumes.

Market timing and demat transactions

Even though the exchange is closed, you can still perform limited actions via your demat account during holidays. These include:

- Viewing holdings and portfolio reports through your online platform.

- Placing after-market orders for the next working day.

- Accessing research tools, charts, and watchlists.

However, order executions, fund transfers, and real-time demat updates only happen when the exchange is operational. Hence, it is wise to align your trading plans with BSE holidays 2025.

BSE holidays vs bank holidays

While BSE holidays affect trading activities, bank holidays affect the settlement and fund transfer processes. In some cases, banks may be closed even when the stock exchange is open. For example:

| Exchange Open | Bank Closed | Implication |

| Yes | Yes | Orders can be placed but fund transfers delayed |

| No | Yes | No trading or settlement activities |

| Yes | No | Normal operations |

Planning demat-related transactions like lien marking for IPOs, SIPs in equity funds, or pledging shares for margin facilities should consider both exchange and bank holiday calendars.

How to keep track of BSE holidays

To avoid missing key dates, consider the following ways to stay updated on the BSE holidays 2025:

- Bookmark the BSE India holiday calendar: The official BSE website regularly updates the holiday schedule.

- Use your stockbroking app or portal: Many platforms display exchange holidays within their calendar or dashboard.

- Set reminders on your trading tools: You can mark important holiday dates to prepare ahead for fund transfers, margin calls, or order planning.

- Follow SEBI and NSE updates: For any market-wide announcements that affect BSE operations.

What happens to trading on special days?

Occasionally, BSE holds Muhurat trading on Diwali. This is a symbolic and limited-hour session usually held in the evening. It holds cultural significance and is used by many investors to make their first trade of the Hindu financial year.

Other special conditions may include:

- Shortened sessions before holidays: Trading hours may be reduced.

- Postponements due to unforeseen events: BSE may declare additional holidays in case of natural calamities, public unrest, or government orders.

All such notifications are issued by BSE in advance and available on its announcements page.

Plan your trading activity wisely

While the BSE holidays 2025 are predefined, planning your trades around them can help you manage settlement cycles, avoid surprises, and maintain better control over your demat operations. If you actively participate in the market, aligning your calendar with exchange and bank holidays can improve execution and reduce delays.

Whether you are an equity investor or someone exploring intraday opportunities, timely awareness of market closures ensures you are never caught off-guard.

Staying informed about BSE holidays 2025 is an important step in managing your stock market participation smoothly. With timely planning and awareness, you can structure your demat and trading activities without last-minute disruptions.

While the Indian stock market offers multiple investment options, it is essential for each investor to assess personal goals, review exchange calendars, and take decisions suited to individual risk preferences. Monitoring official sources such as BSE India, SEBI, and reputed financial platforms can help you stay on track throughout the year.

About the author(s)

Partner Content is carefully curated and socially relevant sponsored content created by FII's marketing team. It is separate from FII's editorial content and is identified as sponsored.